Take me down to Electric Town

A Dive into Consumer Electronics retail in Japan

By David Tonge

The consumer electronics (CE) retail landscape

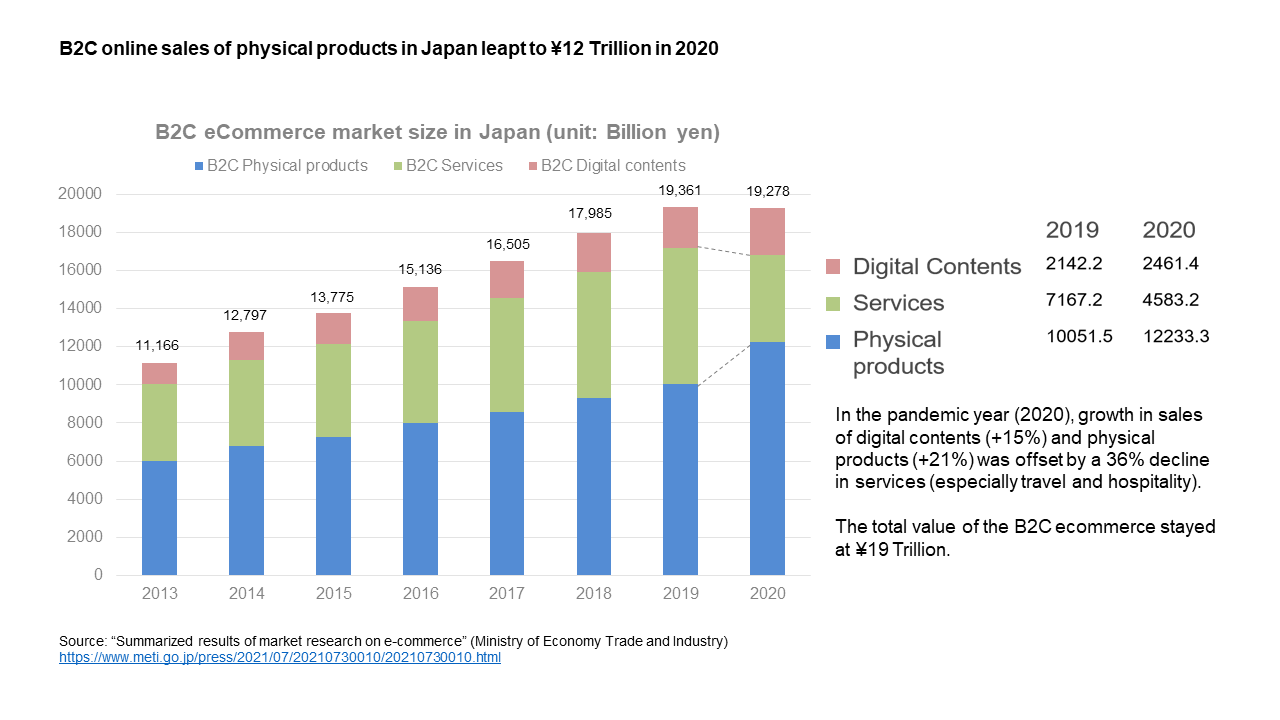

Online shopping has grown dramatically in Japan, which is currently the fourth largest market in the world for online sales, behind China, USA and the UK. From 2011 to 2020, online sales of physical products leapt from around 6 Trillion to almost 12 Trillion Yen (see Figure 1).

Japan's big players in online retail are Amazon and home-grown retailer Rakuten. One thing that differentiates Japan's online retail sector from other countries is the popularity of peer-to-peer auction sites such as Yahoo Auction, Mercari and Rakuma.

Despite the increasing popularity of digital channels to research and buy physical products, many Japanese people still love to shop in real-life stores and to be able to touch products before buying. In contrast to the UK, where physical stores for consumer electronics (CE) are steadily disappearing, in Japan they still play an important role.

The family run CE stores of rural Japan - usually stocking air-conditioning units and countertop dishwashers - are falling victim to the economies of scale of online retailers. In urban Japan, however, CE stores are plentiful. They're usually located in high footfall areas such as major railway hubs and shopping districts, the most famous of these being Tokyo’s Akihabara, known locally as Denki (Electric) Town. Here, the market is dominated by a handful of big brands, including Bic Camera, Yodabashi Camera and Yamada Denki. As soon as you enter these stores, you will see that they sell a lot more than the words ‘Camera’ or ‘Electric’ in their names might imply.

There is nothing quite like the CE store experience

Open 7 days a week from 10 am (there’s usually a queue from 9.45 am) until 10pm, they are brightly lit, fridge temperature (attractive during the summer months) and incredibly noisy with information graphics and point card offers covering every surface and product (see figure 2).

Enthusiastic uniformed staff shout out greetings and the latest offers, while incessant store-branded jingles (a friend bought me a CD of these as a memento) remind you of where you are and which floor to visit. With as many as 12 floors organised by product category, some of these mega-stores also contain Uniqlo and Muji stores, cafes to refuel, bookshops and rest areas where people doze. They are invariably packed full of consumers trailed by very knowledgeable and patient sales assistants.

On the surface, this "in your face" atmosphere has little to commend it. But like a Middle Eastern bizarre or British flea market, the CE store experience is strangely compelling and given the Japanese consumer loves to bargain, this atmosphere is, no doubt, well considered. Like a Las Vegas Casino, once you are in it’s hard to leave.

An important barometer of Japanese Life

In the past, Japan boasted the most advanced consumer technology in the world. In the mid-90’s I would conduct ‘Retail Safaris’ with my clients from Silicon Valley in these CE stores. They would be amazed to see unfeasibly thin laptop computers, phones with huge displays and MP3 players (remember them?) the size of a watch. All of these items were, technologically, light years ahead of any US products but rarely seen outside of Japan. I counted myself as a pioneer to be able to work on some of these products! Almost thirty years later such technologies are commonplace and are, sadly, more likely to be associated with Korean and US tech brands, rather than Japanese makers – but that’s a story for another day.

So what can we learn from these stores? When I embark on a new project or accompany a client on a Japan Market Retail Safari, CE stores are my first port of call to quickly research trends in lifestyle, design & technology, to quiz the sales staff and to pick up on consumers' questions and concerns.

While doing this you are likely to discover interesting insights that are valuable to firms that want to enter the market, as I did recently. The latest innovations revealed some interesting needs and desires:

- To slow life down and enjoy better tasting rice – Hi-end iron pot rice cookers (not aluminium) are growing in popularity among Japanese consumers, despite the high cost at $1500 plus.

- To respond to the lack of space and humid conditions – Compact and elegant vacuum cleaners which live in the room when not in use and also purify the air are becoming popular from brands such as Mitsubishi and Hitachi.

These items don’t just tell us what is or isn’t selling, what colour or design detail is ‘in’. With interpretation they provide perspective on how Japanese consumers think and why they purchase products. That's why they are an important barometer of Japanese life.

The staggering breadth of Japanese manufacturing

A quick glance at the store guide of Bic Camera offers a sense of the breadth of Japanese manufacturing prowess; Household Appliances & Lighting, Camera & Video Drones, Cosmetics & Pharmaceuticals, Stationary & Books, Toys & Hobby Baby Articles (do babies have hobbies?) before moving onto Sports, Bicycles & Golf and finally arriving at Liquor, Drink & Food Gifts. I have missed out at least two thirds of the list here.

To read the list is one thing but to experience the sheer volume of products is quite another. Many of these categories occupy their own floor in the store, and each department is also filled with associated accessories to the main product category.

As a product designer my appetite for exploring new products (especially cameras) is huge, but even for me this is staggering. It does, however, reflect the depth of ingenuity, manufacturing prowess and mercantile savvy of the Japanese, who love to make and consume stuff.

How does this experience differ to CE stores in the West ?

I described the CE store experience as having little to commend it. This is true from an environment viewpoint but, from a Japanese consumers perspective these stores are spot on in a number of important ways, here are two points to consider:

1. Information heavy. The first thing to notice is the amount of information, starting with store navigation and extending to the product display, where the product is typically hidden behind discount labels, specifications, special offers and reams of product leaflets to be taken away and studied (see figure 3). The Japanese love paper.

To me, this over-abundance of labelling devalues the product. It is almost the complete opposite approach to stores in the West, that try to only provide details when they're needed, in an effort to create an environment for consumers to experience products. But it fits Japanese consumers' detailed-oriented, spec-based approach to decision making. Japanese buyers like to study the weight, dimensions, features, and other product details, and make comparisons with competing products. These days they often do research online, or through a plethora of product review magazines, before going to the store to ‘feel’ products before purchasing them.

2. Service, up-selling and discounts. The ever present salesperson can discuss the product details with you to provide reassurance and up sell or add accessories you didn’t know you needed. And you, the consumer, have an opportunity to bargain for a discounted purchase price or free add-ons. This is perhaps surprising, as we don’t think of Japanese people negotiating a price but it exemplifies the famous Japanese ‘customer is king’ service culture.

Recommendations

Since the CE store is a barometer of Japanese consumers' lives, I recommend it as a starting point for your exploration of the market, whether you intend to sell audio systems, jams or beauty creams in Japan. By participating in a guided ‘Retail Safari’ or making a solo expedition you can learn a lot about what is happening in Japanese life and innovation. Be careful, though - You might never leave!